Este documento contiene varios gráficos interactivos. Aquellos que contienen leyendas permiten activar y desactivar la correspondiente línea según lo desee.

Este documento contiene varios gráficos interactivos. Aquellos que contienen leyendas permiten activar y desactivar la correspondiente línea según lo desee.

This document contains various interactive graphs. On those that have legends you can enable and disable the respective curves as you see fit.

Si quieres recibir nuestro boletín energético diario en tu email para conocer, entre otros datos, el precio de la electricidad del día siguiente, suscríbete a esta lista:

La información contenida en el presente documento se basa en la información obtenida tanto de fuentes propias como de información de carácter público o suministrada por otras terceras entidades, sin que GRUPO ASE haya procedido a verificar la exactitud de la información obtenida por las fuentes citadas, así como está basada en la interpretación de los mercados de electricidad y gas que realizan los analistas de Grupo ASE. Grupo ASE se compromete a llevar a cabo su cometido con la mayor diligencia y profesionalidad, pero no garantiza ni asegura el resultado de sus análisis o de las recomendaciones realizadas. Los datos, informaciones, previsiones y recomendaciones contenidas en el presente documento han sido elaboradas con independencia de las circunstancias y objetivos particulares de sus posibles destinatarios y tienen como objetivo orientar a nuestros clientes facilitándoles un esquema analítico para la toma de decisiones e identificación de las diferentes tipologías de variables y riesgos, por lo que tienen un carácter orientativo y el uso que de las mismas se haga será responsabilidad exclusiva del cliente. Ni el presente documento ni su contenido constituyen una oferta, invitación o solicitud de compra, suscripción o cancelación de posiciones. Grupo ASE no asume ninguna responsabilidad por cualquier pérdida, directa o indirecta, que pudiera derivarse de la utilización de este documento o de la información, previsiones o recomendaciones contenidas en el mismo por parte de sus destinatarios. El cliente o destinatario del presente documento es el responsable último de las decisiones relativas a la aceptación del cierre de precios y posiciones a futuro, no pudiendo exigir a Grupo ASE ningún tipo de responsabilidad derivada del no cumplimiento de sus previsiones.

Monthly summary

Analysis

Price on the daily markets

Final average price on the free market

ASE ICEE Index

International markets

Demand

Generation

Clearing prices by technology

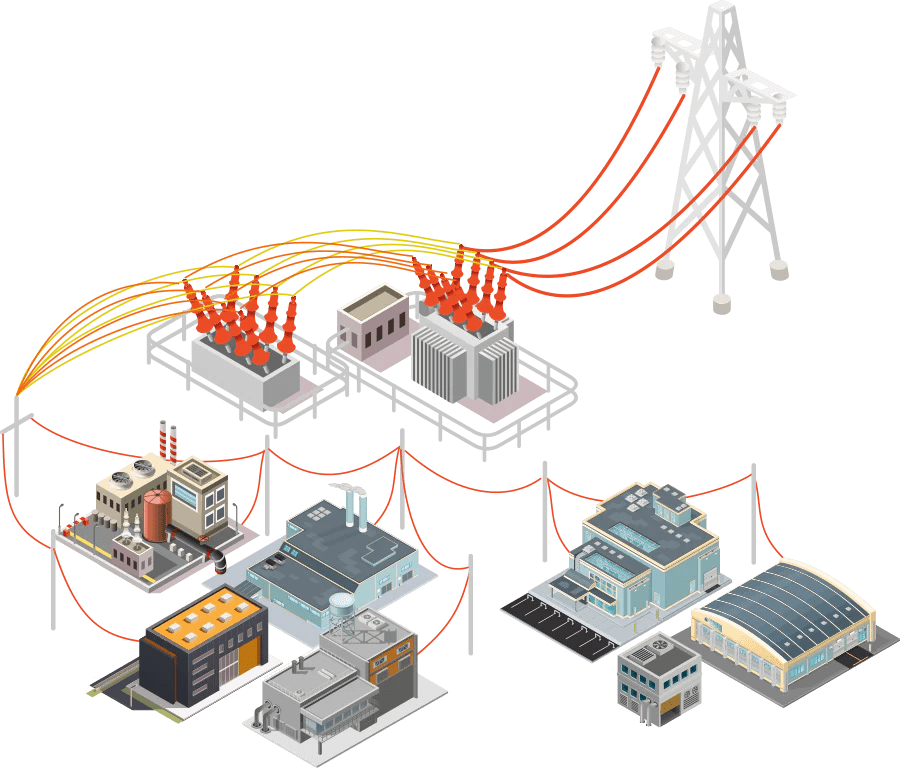

Interconnection balance

Electric power futures markets

Gas market report

Other raw materials

Grupo ASE Indexes

Executive summary in PDF

▲ +X% vs august 2023

Mercado ibérico

Q3-23: X (▲+X%)

YR-24

España: X (▼-X%)

Francia: X (▲+X%)

Alemania: X (▲+X%)

Futuros Brent: ▲+X%

Gas (MIBGAS): ▲+X%

Carbón (API2 Month+1): ▲+X%

CO2 (EUA): ▲+X%

Respecto al mes anterior

vs july 2022

Este índice ofrece una tasa de evolución objetiva basada en el perfil mayoritario de las pymes industriales españolas, simulando un contrato indexado a POOL con tarifas 6.1TD y 6.2TD.

6.1TD: ▼ -X%

6.2TD: ▼ -X%

vs july 2022

▲ +6,17% vs july 2023

▼ -68,88% vs august 2022

▼ -1,4% vs august 2022

▼ -6,7% vs august 2022

Spain and Portugal market

YR-23

Spain: 183,00 (▼ -10,73%)

France: 265,94 (▼ -40,60%)

Germany: 233,71 (▼ -37%)

Futures Brent: ▼-1,2%

Gas (MIBGAS): ▲+65,9%

Coal (API2 Month+1): ▼-29%

CO2 (EUA): ▼-6,5%

Compared to the previous month

This index offers an objective evolution rate based on the majority profile of Spanish industrial SMEs, simulating a contract indexed to POOL with 6.1TD and 6.2TD rates.

6.1TD: ▼ -2,1%

6.2TD: ▼ -2,1%

vs july 2022

Electricity prices rise by 6.2% in August

The average daily price of the Spanish wholesale (POOL) market in August was set at €96.05/MWh. This is a 6.2% increase compared to last July, but it is a significant 68.9% below its level from a year ago.

Volatility has been high throughout the month, and on days with high temperatures and low wind generation, the support provided by expensive gas has driven up the price.

In context, the Spanish price has been very similar to the average of the major European economies, which stood at €96.86/MWh. France recorded the lowest at €90.87/MWh, and Italy the highest at €111.89/MWh.

Compared to the peak of the European energy crisis, when electricity prices reached highs of €500/MWh last August, the current situation is much more contained, at least compared to the expectations back then. However, gas and electricity prices continue to register well above their historical averages.

Photovoltaic output grows by 35%, but it doesn’t prevent prices from remaining tethered to gas

Photovoltaic production in Spain has increased by 35% compared to a year ago because 4,162 MW more capacity has been installed during this period, representing a 22.8% growth. With a total of 22,380 MW, photovoltaic is now the third technology with the most installed capacity in Spain. It is only surpassed by wind energy (30,371 MW) and combined cycle gas plants (26,250 MW).

This extraordinary growth has photovoltaic energy nearly taking the second spot in the energy mix, with 19.5%. Nuclear is first at 22.5%, but even so, during daylight hours, photovoltaic covers up to 42% of total generation and doubles nuclear contribution.

The rest of the technologies, which have more flexibility to shut down, have reduced their output this month to make “room” for the incoming solar energy. However, the growth in photovoltaic has not managed to displace combined cycle gas plants (CCGs) during peak hours, where they maintained a 10% share of the mix. This participation of the CCGs, although minimal, was enough for many days, during most hours, for prices to remain tied to the cost of gas and stay higher than expected.

As seen in the graph, wind generation has also significantly reduced its contribution during daylight hours, and to a large extent, this is what has allowed the CCGs to maintain their presence. This cutback in wind energy is something that happens in the summer, ever since solar generation started increasing its output, and we’ve analyzed its impact on prices on other occasions as well.

Increase in Wind Curtailment

Part of the reduction in wind generation during daylight hours can be explained by technical restrictions or forced shutdowns ordered by the electrical grid, as the accumulation of power in specific areas could overload the grid at points where renewable assets are located. At certain times, the electrical system is inflexible, and technologies like coal and nuclear are very expensive to shut down due to their high fixed costs, whereas reducing wind is much cheaper.

However, not all the reduction in wind during daylight hours can be attributed to stops due to technical restrictions. A portion is due to what are termed “economic curtailments.” These occur when bids from wind plants don’t match in the daily auction because their offers are higher or because a minimum revenue for the asset isn’t met (complex offers). Ultimately, at certain times, it may be more profitable for a wind generator to reduce generation to avoid having all its potential output matched at zero in the market.

According to our calculations, wind curtailments (both technical and economic) could have exceeded 500 GWh in August, meaning they could have reached 15% of wind generation. And although we don’t have data to corroborate this, it’s very possible that economic curtailments are also occurring in photovoltaic plants.

As the following graph shows, in months with scarce photovoltaic production, like February, wind has behaved much more steadily during those hours of the day compared to August and it has nothing to do with a climatic effect, as has been argued at times.

The deployment of new renewable capacity is happening at the same time as electricity demand is reducing during daylight hours, due to the growth in self-consumption. This threatens to result in falling prices and an increase in curtailments.

If the pace of growth for new renewable power stays at 4-5 MW per year, as in the last three years, economic curtailments could exceed 30% of renewable generation at specific times in 2024. Therefore, these curtailments will have to be taken into account when considering the investment and profitability of renewable assets.

The increase in French nuclear power reduces our export balance

Spain’s export balance has dropped 55.8% this month compared to the same period last year. The cause has been the improvement in nuclear production in France, which has grown 35% compared to last year, when drought and maintenance issues affected much of its nuclear fleet.

The disappearance of the “Iberian gas price cap” effect this summer has also had a significant impact on reducing exports, as gas prices have not reached the established “cap.”

As a result of this lower export balance, electricity generation has fallen by 6.7% in Spain. Specifically, combined cycle gas plants have reduced their output by 41% compared to the same period last year.

Demand continues to plummet during daylight hours

This month, electricity demand has dropped 1.5% compared to the same period last year, despite high temperatures on the peninsula and increased tourist activity. And, as has been the case in recent months, the reduction has been much more pronounced during daylight hours, with a drop of over 4%. This is explained by the increase in photovoltaic installations for self-consumption in both industry and households.

Only during peak demand hours, between 8:00 PM and 10:00 PM, has there been a slight increase in demand, by 1.5%.

Regarding industrial electricity demand, the latest data from July showed a significant reduction of 8.9%. The biggest drops were recorded in the paper industry sector (-35.7%), wholesale trade (-21.1%), and metallurgy (-12.9%).

As for gas demand, it declined by 11.2% in August, although conventional consumption (households and SMEs) increased by 24.6%. What has sharply decreased is gas consumption for electricity generation, down by 36.6% compared to the same period last year.

In fact, gas demand in the industrial sector, according to the latest data published in July, showed an increase of 14.3%. This is due to the significant reduction in gas prices compared to a year ago, allowing major consumers like the refining sector to increase their demand by 83%. Other sectors like textiles (+34.5%) and chemicals (+20.8%) have also increased their demand. On the flip side, sectors like metallurgy (-12.3%) and construction (-17.1%) have reduced theirs.

Maintenance activities and the potential for supply disruptions in Australia are driving up gas prices

The daily price of European gas (TTF spot) experienced extreme volatility throughout August, closing with a 12.8% increase to €33.15/MWh. Meanwhile, the average price of the Spanish gas market (MIBGAS) was slightly higher, at €33.86/MWh.

The market has reflected concerns over the announcement of worker strikes at Australian Chevron and Woodside facilities, which account for around 10% of global supply. Europe has limited direct trade with Australia, but any potential cutback could lead Asian buyers to turn to the liquefied natural gas (LNG) market. This, in turn, would increase their competition with European buyers for North American LNG.

Workers at Woodside (Australia) reached an agreement on August 24, and prices retreated, but they rose again on the 28th when Chevron workers announced they would go on strike.

This also added pressure to the price, with a 45% decline in gas imports from Norway due to planned maintenance interruptions.

This high volatility in gas prices highlights the current lack of global flexibility in the LNG market in the face of potential supply disruptions. This, in turn, leads to high uncertainty and significant fluctuations in its valuation, which directly impact European electricity markets. This is because electricity generation from gas (combined cycles), as the dominant fuel in setting prices in the marginalist system, continues to drive both the level of prices and the volatility of the electricity market.

Gas prices for the winter remain high

During the first quarter of this year, future gas prices dropped sharply due to a mild winter, moderate demand, and high LNG imports. During the second and third quarters of 2023, summer prices continued to fall. However, winter 23/24 prices have remained relatively high.

It’s common to see a contango (upward curve) for winter months because operators tend to accumulate a higher risk premium for winter deliveries, due to greater uncertainty about temperature and demand. However, this year it’s especially high.

The reason for this significant discount between summer and winter prices is due to improved short-term prospects in European gas markets because of high inventory levels in storage facilities. Meanwhile, the market still holds a sense of high risk going into the upcoming winter, due to the possibility of colder temperatures and increased competition between Asia and Europe.

The current weakness in summer gas prices (despite their volatility) is based on specific seasonal factors, which have led to gas reserves being at 92% of their capacity, 10 points above their five-year average. In the case of Spain, gas storage reached 100% of its capacity in August.

This excess inventory has put the brakes on prices during the summer, as injections from gas storage facilities serve to meet demand during the summer period. Additionally, there is a risk that storage capacity may hit its limit by the end of summer, reducing Europe’s need to purchase LNG, and consequently, easing prices.

What has facilitated the current high level of inventories is weak demand, both due to unusually warm temperatures last winter and high gas prices.

Although it’s hard to measure the impact, the sky-high prices of 2021-22 seem to have caused a structural destruction of industrial demand and offshoring.

The reduction in demand is around 22% below pre-crisis levels and is seen across all sectors (industrial, residential, and energy). All signs point to this continuing because prices are seven times lower than last year, but demand is not reacting positively, which suggests possible structural destruction.

The weak European demand and high reserves reduce LNG imports

Europe has reduced its gas imports to an average of 676 mcm/d, which represents an 18% drop compared to the same period last year. A significant part of this decline is due to the reduction of LNG imports to 229 mcm/d, a 20% decrease compared to August 2022.

Weak Asian demand has allowed Europe to source LNG during the first part of 2023 at relatively low prices. However, as the summer has progressed, the limitation of European storage capacity (it’s now full) has caused LNG to start diverting to other markets like Asia and Latin America.

In Asia, futures contracts for shipments of liquefied natural gas (LNG) saw a strong surge due to potential strikes at Australian Woodside and Chevron facilities. At this point, the reference market prices (JKM) are offering a premium over the European market (TTF) of 2.11 €/MWh, so it’s expected that Asian buyers will continue to be more active and attract more shipments.

Japan’s LNG storage has slightly increased and reached its average levels for this time of year over the last five years, but it is still significantly below last year’s levels. In China, LNG imports have increased compared to July and are up more than 30% year-on-year. However, compared to 2021, their import levels are slightly lower.

U.S. exports continue at a strong pace

According to the U.S. Energy Agency, for the rest of 2023 and 2024, dry natural gas production is expected to average around 104 Bcf/d, very similar to the average for the first half of 2023 (102 Bcf/d). Starting from the fourth quarter of 2024, production is expected to increase with the commencement of new pipelines and two new LNG facilities.

In the last week of August, average natural gas deliveries to U.S. LNG export terminals increased by 2.6% and reached an average of 12.1 Bcf/d. So far in 2023, the utilization of maximum capacity at its seven LNG export facilities has remained very high, averaging 83%, compared to 80% in 2022. Ship departures from these facilities also increased in the last week of August, reaching 23 loads.

Restrictions on the entry and exit of ships in the Panama Canal could influence the rise in prices for North American LNG shipments to Asia. High temperatures and drought are impacting the water level in the canal, and at this moment, there are 120 ships waiting to transit.

The Spanish futures market appears flat with respect to the winter and 2024

The prices of the Spanish electrical futures contracts market (OMIP) closed August without significant differences compared to July. Generally speaking, the market is very flat, and the quotations for 2024 are basically moving at spot price levels. On the other hand, the reference market in Germany has seen higher volatility due to movements in the gas markets, where there is a higher price premium for 2024 compared to spot prices.

This lower volatility in Spain’s futures pricing could be explained because buyers feel that the Iberian market is less sensitive to gas prices, given its high renewable energy production. Or, what seems more likely, because the futures market shows little movement due to its low liquidity.

Currently, the Spanish price for 2024 is trading around 105 €/MWh, while the German and French prices are at 134 €/MWh and 146 €/MWh, respectively.

The bearish sentiment that was prevalent in the European energy market in late July and early August due to healthy gas reserves on the continent and weak demand was abruptly interrupted by news of possible strikes at Australian LNG facilities.

Europe has been impacted by the potential shutdown of a facility over 15,000 kilometers away, as Australia currently supplies 25% of the LNG to major Asian buyers (Japan, Korea, and China). Given the tight global LNG supply after the Russian gas supply cut to Europe, the market is experiencing high levels of nervousness and tension. The possibility that Asian buyers might have to compensate for that reduction and increase competition with Europe quickly spread throughout the market.

The reality is that the Australian production reduction would only affect 20% of the Gorgon and Wheatstone plants, making its impact limited. Therefore, prices in Europe should return below the €30/MWh range before the start of winter, supported by record gas reserves and weak demand.

However, close attention should be paid to potential delays in Norwegian facility maintenance, the increase in Asian demand, and the likelihood that European temperatures will be colder than those of the past winter.

Tension and volatility in the gas market seem assured for the remainder of 2023, leading to significant fluctuations in electricity prices.

Looking ahead to 2024, the supply and demand for LNG are also expected to remain relatively inelastic, leading us to predict that futures markets for gas and electricity will maintain elevated quotes compared to their historical averages.

Juan Antonio Martínez y Leo Gago

Grupo ASE Analysts

The demand continues to plummet during solar hours due to the growth of self-consumption

Planned maintenance and potential supply disruptions in Australia are driving up the price of gas

El POOL cerró en 96,05 €/MWh. Baja un 68,9% frente al mismo mes del año anterior.

▲

+6,17% vs july 2023

▼

-68,88% vs august 2022

Los precios horarios del POOL bajan en todas las horas respecto a abril.

+4,32% vs july 2023

-68,53% vs august 2022

-0,18% vs july 2023

-79,51% vs august 2022

+17,02% vs july 2023

-81,55% vs august 2022

+21,65% vs july 2023

-79,74% vs august 2022

▼

-2,65% vs july 2023

▼

-84,67% vs august 2022

La demanda de electricidad baja un 6,9% frente al mismo mes del año pasado.

Durante las horas de radiación solar la demanda se reduce más debido al efecto de la potencia instalada de autoconsumo en hogares y empresas.

La generación de electricidad baja un 6,7% respecto al mismo mes del año pasado.

La generación solar dominó las horas de radiación con más del 40% del mix.

La generación proveniente de fuentes renovables representó el 48% del mix frente al 40,4% del mismo mes del año pasado.

La generación libre de emisiones CO2 representó el 72,2% del mix frente al 60,7 del mismo mes del año anterior.

Estos son los últimos datos de potencia instalada publicados por REE:

La producción eólica fue un 6,72% inferior que la media de los últimos 5 años.

La generación fósil representó el 21,5% del mix frente al 30,7% del mismo mes del año anterior.

Las reservas hidroeléctricas se encuentran al 118,6% sobre al año pasado y al 82,7% sobre la medida de los últimos 10 años.

La energía hidráulica dominó lo precios de marginales de casación en el 32,59% de las horas.

El saldo exportador de las interconexiones disminuyó en junio un 27,4% respecto al mismo mes del año pasado.

La subida de los precios de gas para el próximo verano e invierno en más de un 20%, así como el incremento de las emisiones de CO2 en un 11% hasta los 89,57 €/tCo2, impulsaron las cotizaciones de los productos del mercado de futuros eléctricos del tercer y cuarto trimestre europeos. El contrato de electricidad alemán para el tercer trimestre (Q3-23) subió un 21,6%, hasta los 102,04 €/MWh, mientras que el Q3-23 español se incrementó un 20,1%, hasta los 101,50 €/MWh.

El Yr-24 español consiguió mantenerse por debajo de la barrera de los 100 €/MWh, cerrando con un precio de 92,35 €/MWh y con una bajada del 4,8% a pesar del contexto de subida de los precios y del resto de los mercados europeos. El Yr-24 alemán cerró junio con una subida del 17,3%, hasta los 143,71

El Yr-24 español sigue ampliando su diferencial respecto al mercado de futuros alemán de referencia en Europa y los márgenes de chispas limpias (CSS), que sirven de referencia para marcar los precios marginales de electricidad.

Durante junio, los flujos de Noruega a los Países Bajos disminuyeron un 25%, junto con los de GNL, que se redujeron un 12%. Esto ha provocado un ligero repunte del precio spot del 1% respecto a mayo. Sin embargo, los mercados de futuros a corto sí experimentaron un importante repunte debido al mantenimiento noruego y la previsión de reducción de las importaciones de GNL. Los contratos de futuros del TTF del año 2023 registraron una subida del 13,7% para el Q3-23 y del 18,7% para el Q4-23, mientras que el Cal-24 subió un 12,9% hasta los 53,10 €/MWh. El buen dato de las reservas de gas en Holanda, que se encuentran al 77%, evitaron una subida mayor de los precios de los futuros.

El precio medio diario de junio cerró en 31,01 €/MWh, con una subida del 6,1%, reduciéndose la prima de descuento respecto al TTF y demás mercados de gas europeos. El motivo fue la reducción de las importaciones de gas argelino, que elevaron el precio del gas español. La razón de las menores importaciones argelinas se debió al mantenimiento programado en la ruta Medgaz, que redujo la capacidad de exportación a España. No obstante, las instalaciones de almacenamiento españolas se mantuvieron en niveles de máximos históricos, a un 97% de llenado, lo que supone 65 puntos porcentuales por encima de los niveles del mismo periodo de 2022.

Los contratos de futuros del año 2023, al igual que el resto de mercado europeos, registraron importantes subidas, mientras que el Cal-24 se incrementó un 16,1% hasta los 49,13 €/MWh, manteniendo una prima de descuento sobre el TTF de 4 €/MWh.

La reducción de las importaciones europeas en la segunda parte de junio alimenta la incertidumbre y volatilidad de los precios

Las importaciones de gas europeas han disminuido cerca de un 12,5% respecto al mes de mayo y, con respecto al mismo mes del año pasado (junio 2022), la reducción alcanza el 24,3%.

La reducción de los cargamentos de GNL que llegan desde EEUU y los mantenimientos de las plantas noruegas han reducido las importaciones de gas europeas durante junio a su punto más bajo en los últimos 18 meses.

La larga parada de la planta de noruega de Nyhamna, que permanecerá fuera de servicio 24 días más de lo previsto, eliminará aproximadamente 1.200 millones de m3 de suministro hacia Europa. La fecha de reanudación de la actividad de la planta sigue siendo incierta, lo que alimenta aún más la volatilidad de los precios.

Las entregas estadounidenses a Europa de GNL han disminuido desde principios de junio debido al mantenimiento programado en la terminal de Sabine Pass. Las obras han dejado la terminal de exportación de GNL funcionando a la mitad de su capacidad desde principios de mes de junio. En junio, tan solo 10 cargamentos salieron de la terminal con destino a Europa, frente a los 27 de mayo y los 32 de abril. El año pasado, Sabine Pass representó alrededor del 40% de los envíos estadounidenses a Europa.

Dado que el año pasado muchas plantas de GNL y de procesamiento de gas funcionaron a su máxima capacidad en un contexto de precios de gas de máximos, ahora los operadores están aprovechando el entorno de precios más bajos y la baja demanda estacional para programar periodos de mantenimiento más intensos.

La competencia entre Asia y Europa por el GNL eleva los precios de gas

Otro factor que está entrando en juego en la reducción de las entregas de GNL desde EEUU a Europa es la reapertura del arbitraje entre los mercados europeos y asiáticos. A principios de junio, el precio del JKM se situó de nuevo por encima del TTF europeo, lo que puede haber inducido desde las terminales de EEUU a enviar cargamentos a Asia antes que a Europa. En junio, alrededor del 40% de la producción de EEUU se había enviado a Asia, frente al 20% de media en lo que va de 2023.

Los precios europeos subieron con fuerza para cerrar la “brecha” con el JKM en la segunda semana de junio, apoyados además por la noticia de la larga parada de la planta de procesamiento de Nyhamna (Noruega). Sin embargo, en la última semana los precios del JKM volvieron a subir hasta 11,96 $/MMB, por el aumento de las importaciones asiáticas, abriendo de nuevo un diferencial respecto al TTF que bajo hasta los 10,72 $/MMBtu. Esto podría afectar de nuevo a una reducción de los envíos desde las terminales de EEUU a Europa durante julio, si Europa no vuelve a cerrar el diferencial.

La competencia entre Europa y Asia se está “calentando” a medida que los compradores asiáticos regresan al mercado de contado y los compradores europeos necesitan seguir garantizándose cargamentos suficientes para llenar las reservas de gas de cara al invierno. China ha incrementado las importaciones en los últimos 3 meses en más de un 15% respecto al año pasado, aunque aún se encuentra lejos de los niveles de 2021.

Las reservas alcanzan el 77% y evitan una escalada mayor del precio

El gas almacenado en Europa se sitúo en un 77% a final de junio, 16 puntos porcentuales más que en la misma fecha de 2022.

Aunque las tasas de inyección en los almacenamientos han mostrado signos de ralentización en las últimas semanas, los amplios inventarios europeos han garantizado que los precios de gas en Europa no se dispararán por la fuerte reducción de las importaciones de gas.

Grupo ASE, con la información que le proporcionan 600 puntos de suministro, elabora índices de precio y consumo de electricidad:

Mayo se anotó un ligero aumento del 0,42% del consumo frente al mismo mes del año anterior.

GRUPO ASE

(Sede central)

Gran Vía 81, piso 6º, departamento 2.

48011 – Bilbao (Bizkaia)

Tel: 944 18 02 71

ase@grupoase.net

MÁS SEDES

Comunitat Valenciana

Avenida de Benidorm, 1

En-37 · San Juan · 03550 (Alicante)

Tel: 966 593 464 – 606 393 077

ase@grupoase.net

Región de Murcia

C/ Trapería, 30, 5º B

30001 – Murcia

Tel: 618 212 774

ase@grupoase.net

Comunidad de Madrid

Avenida de América, 32

28922 – Alcorcón (Madrid)

Tel: 912 262 209

ase@grupoase.net

Catalunya

C/ Comte Urgell, 286 · Pral. D

08036 · Barcelona

Tel: 934 186 424

ase@grupoase.net

Andalucía

Calle Pago del Lunes, 9

18195 · Cúllar Vega (Granada)

Tel: 858 952 918

ase@grupoase.net

Grupo ASE nace en Bilbao en 2001 y está presente en todo el territorio nacional. Somos la empresa del sector eléctrico que defiende los derechos e intereses económicos de los consumidores industriales y agentes del sector con capacidad de compra. Nuestros valores son independencia, conocimiento técnico, poder de compra y optimización de la energía y su coste como parte de un servicio integral. En la actualidad contamos con más de 400 clientes y alrededor de 600 puntos de suministro.