This document contains various interactive graphs. On those that have legends you can enable and disable the respective curves as you see fit.

This document contains various interactive graphs. On those that have legends you can enable and disable the respective curves as you see fit.

The information contained in this document is based on information obtained both from own sources and from information of a public nature or provided by other third parties. GRUPO ASE has not verified the accuracy of the information obtained from the aforementioned sources. The information is also based on the interpretation of the electricity and gas markets carried out by analysts of Grupo ASE. Grupo ASE undertakes to carry out its task with the utmost diligence and professionalism, but does not guarantee or ensure the result of its analyses or the recommendations made. The data, information, forecasts and recommendations contained in this document have been prepared regardless of the particular circumstances and objectives of their potential recipients and aim to guide our customers by providing them with an analytical scheme for decision-making and identification of the different types of variables and risks, therefore they are of an indicative nature and customer will be solely liable for their use. Neither this document nor its contents constitute an offer, invitation or request for purchase, subscription or cancellation of positions. Grupo ASE assumes no liability for any direct or indirect loss that may arise from the use of this document or the information, forecasts or recommendations contained therein by its recipients. The customer or recipient of this document is ultimately responsible for decisions regarding the acceptance of the closing of prices and future positions, and cannot demand from Grupo ASE any type of liability arising from non-compliance with its provisions.

Si quieres recibir nuestro boletín energético diario en tu email para conocer, entre otros datos, el precio de la electricidad del día siguiente, suscríbete a esta lista:

▼ -2,74% vs junio 2023

▼ -64,9% vs julio 2022

▲ +X% vs julio 2023

▼ -X% vs julio 2022

▼ -X% vs julio 2022

Mercado ibérico

Q4-23: 115,00 (▼-3,0%)

YR-24

España: 101,25 (▼-X%)

Francia: X (▲+X%)

Alemania: X (▲+X%)

Futuros Brent: ▲+X%

Gas (MIBGAS): ▲+X%

Carbón (API2 Month+1): ▲+X%

CO2 (EUA): ▲+X%

Respecto al mes anterior

vs junio 2022

Este índice ofrece una tasa de evolución objetiva basada en el perfil mayoritario de las pymes industriales españolas, simulando un contrato indexado a POOL con tarifas 6.1TD y 6.2TD.

6.1TD: ▼ -X%

6.2TD: ▼ -X%

vs junio 2022

The daily electricity price has dropped slightly by 2.74%

The daily price of the Spanish wholesale (POOL) market in July closed at €90.47/MWh. It is a slight 2.74% decrease compared to last month and is 64.9% cheaper than a year ago.

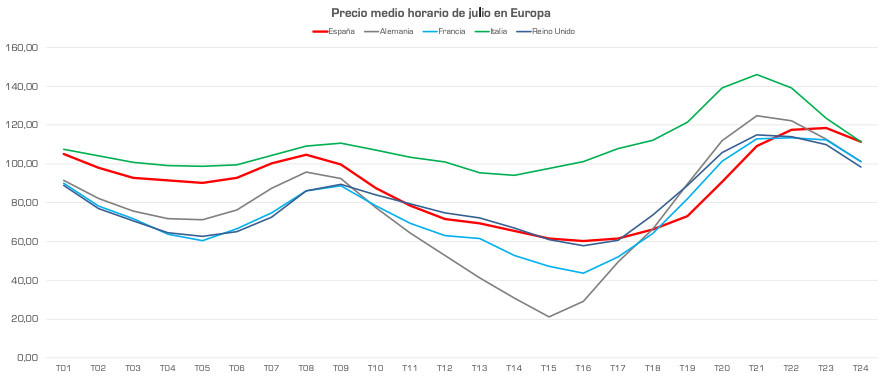

Negative prices in Germany and France beat the Spanish market in July

The average Spanish electricity price has ceased to be the most competitive among the major European economies, after 16 consecutive months, since March 2022.

Prices have plummeted in Germany during the central hours of the day. Many days have registered negative prices due to the combination of low demand and high solar generation during those hours. In fact, on July 2nd, negative prices in the Netherlands, Germany, and Austria reached -€500/MWh, the minimum according to European Union regulations.

Although this is not a new phenomenon, its scope and duration are indeed increasing, highlighting the growing demand flexibility deficit in Europe. In Germany, the lack of flexibility in its coal fleet and the high installed solar capacity (58.9 GW) pose a challenge to its electrical system.

Negative prices are not allowed in Spain, and we have also not seen “zero” prices in July. High temperatures in our country lead to an increase in demand during the central hours, which can be 30% higher than during the same time span in spring, which “neutralises” the strong solar generation. Indeed, it is in spring when the most favourable weather conditions in Spain are seen for “zero” prices, which we have already seen in April and May.

Electricity generation drops by 10% and photovoltaic grows by 32%

This month, photovoltaic generation has been 32% higher than a year ago and has taken the third position in the mix, after nuclear and combined cycles. In contrast, wind generation has decreased by 13%.

Total electricity generation has been 10% lower due to the significant reduction in exports (-78.3%) and the drop in demand (-3.8%). As we pointed out in our fortnightly advance, the disappearance of the gas price cap and the increase in French nuclear production have led to a shift in the balance with our French neighbours from exporter to importer.

Combined cycle gas (CCG) plants have seen the greatest reduction in their production (-42.5%). Despite this, the CCGs have occupied the second position in the mix, contributing 19.5%, only lower than nuclear (20%). The significant presence of CCGs during the central hours of the day, due to lower wind generation, has prevented the price of electricity from falling further in July.

European gas reserves exceed 85% and pressure drops in the short term

In Europe, gas prices have again shown decreases due to low demand because of the warm weather, the return of Norwegian supply, and the fact that gas reserves reached 84.5% of their capacity on July 28th.

This high level of storage suggests that the 90% target set by the European Commission for all member states by November 1st will be met much earlier than expected. By the end of the month, the price for the winter 22/23 product has dropped to €45/MWh, down from €52.7/MWh in June.

The state of gas inventories and the increase in pipeline imports from Norway are offsetting the drop in liquefied natural gas (LNG) imports in recent weeks. This month they have increased by about 5.3% compared to June, but are 18.9% lower than in July of the previous year.

Over the coming months, European LNG buyers will have to offer a premium to attract gas carriers as competition is growing. Asian buyers are increasing their activity in the spot LNG market as their demand for gas for cooling is increasing due to high temperatures.

In addition, countries like India or Thailand are taking advantage of the lower prices at this time, compared to what is expected when the winter demand cycle begins.

The price of electricity in Spain for 2024 again exceeds €100/MWh

The Spanish Yr-24 electricity product has once again risen above the €100/MWh barrier and closed at €101.25/MWh, having increased by 9.6% compared to the close of June. On the other hand, the German Yr-24, a reference in Europe, is at €143.13/MWh.

Although the good condition of European gas inventories has helped reduce short-term prices, there is still high uncertainty for 2024. Last year the winter was mild and allowed Europe to cope with the high demand season for gas. However, if the upcoming winter is cold, the situation could rapidly worsen, leading to a return of supply shortage concerns

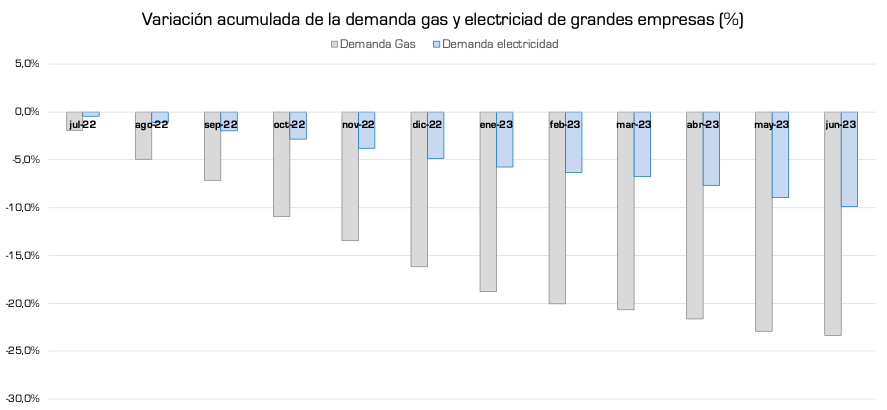

Industrial energy demand does not pick up despite falling energy prices

Industrial energy demand has fallen again in July and shows no signs of recovery, despite the significant drop in prices compared to last year.

The electricity demand from large companies has contracted by 9.9% in the last 12 months. During this period, the electric consumption of large companies has reduced its share in the total electricity demand, from 48.8% to 46.6%. In terms of its gas consumption (excluding the electricity and refining sectors), it has seen a cut of 23.4%.

The metallurgical sector, which accounts for 24.5% of the electricity demand in the industry, has reduced its consumption by 10.7% in the last year. It is followed by the chemical sector (-9%) and paper manufacturing (-8.8%). The overall drop in the industry has not been greater due to the automotive sector, whose demand has grown by 6.8%.

Metallurgy also takes the first place in the cut in gas consumption, with a setback of 20.5% in the last year. In second place is paper manufacturing (-14%), and in third place the chemical sector (-6.9%).

We have long been warning that the decrease in industrial energy demand in Spain is alarming. High gas prices are affecting more intensive industries such as metallurgy and chemicals.

Compared to last year’s highs, amidst a crisis caused by Russian supply cuts, the reference prices for gas in Spain and Europe have plunged by approximately 90%, and electricity prices have fallen by about 60%. However, the current levels almost double those of the average for the period 2019-2021.

Some sectors with intensive energy consumption are questioning whether it makes sense to produce in Europe. This is the case for the chemical sector, in which Europe has already lost up to a quarter of its production. The German multinational BASF closed several plants in its large Ludwigshafen center earlier this year and plans to cut up to 2,600 jobs.

In addition to the energy costs they are facing, another factor for large multinational companies to consider when deciding whether or not to maintain their industrial plants in Europe are the investment costs required for their “decarbonisation.”

The European industry is going through a crisis due to three factors: the drop in demand for goods, increased international competition, and the increase in the cost of credit. The most industrialised countries are already feeling it. Germany, whose industrial sector accounts for 27% of its GDP (compared to 15% in Spain), has entered a recession.

During the energy crisis, most of the measures taken by governments have sought to reduce the impact on household bills. In contrast, Spanish and European industry continues to demand specific energy policies that help increase the efficiency of their production processes, maintain their competitiveness, and tackle the reduction of their CO2 emissions.

Juan Antonio Martínez & Leo Gago

Grupo ASE Analysts

Negative electricity prices are being recorded in Central Europe during the middle of the day due to a combination of low demand and high solar generation.

The industry requires a specific energy policy to increase its efficiency, maintain its competitiveness, and address the reduction of its CO2 emissions.

-1,87% vs junio 2023

-63,82% vs julio 2022

+6,4% vs junio 2023

-74,62% vs julio 2022

-14,94% vs junio 2023

-80,63% vs julio 2022

-18,18% vs junio 2023

-75,39% vs julio 2022

-33,13% vs junio 2023

-62,67% vs julio 2022

GRUPO ASE

(Sede central)

Gran Vía 81, piso 6º, departamento 2.

48011 – Bilbao (Bizkaia)

Tel: 944 18 02 71

ase@grupoase.net

MÁS SEDES

Comunitat Valenciana

Avenida de Benidorm, 1

En-37 · San Juan · 03550 (Alicante)

Tel: 966 593 464 – 606 393 077

ase@grupoase.net

Región de Murcia

C/ Trapería, 30, 5º B

30001 – Murcia

Tel: 618 212 774

ase@grupoase.net

Comunidad de Madrid

Avenida de América, 32

28922 – Alcorcón (Madrid)

Tel: 912 262 209

ase@grupoase.net

Catalunya

C/ Comte Urgell, 286 · Pral. D

08036 · Barcelona

Tel: 934 186 424

ase@grupoase.net

Andalucía

Calle Pago del Lunes, 9

18195 · Cúllar Vega (Granada)

Tel: 858 952 918

ase@grupoase.net

Grupo ASE nace en Bilbao en 2001 y está presente en todo el territorio nacional. Somos la empresa del sector eléctrico que defiende los derechos e intereses económicos de los consumidores industriales y agentes del sector con capacidad de compra. Nuestros valores son independencia, conocimiento técnico, poder de compra y optimización de la energía y su coste como parte de un servicio integral. En la actualidad contamos con más de 400 clientes y alrededor de 600 puntos de suministro.